8.8.2013 – intraday trades [-2R/half]

STATS:

Trades: 2

Return: -1R (-1{0.5%} – 1{0.5%})

Pays: RANGE FADE, BAF

Pairs traded: EURUSD,USDJPY

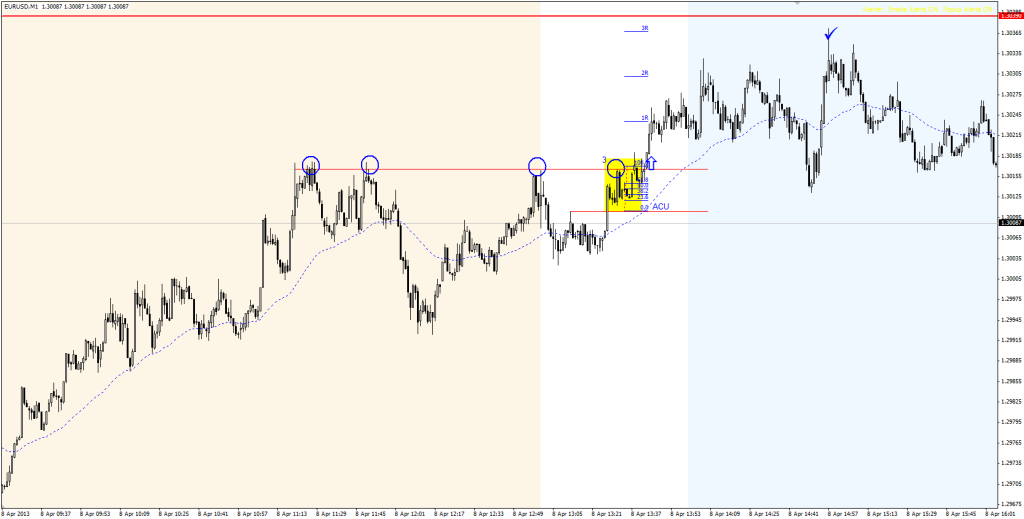

Comment EURUSD:The market broken ASIAN highs and I saw an opportunity in going LONG if the market revisits the ASIAN HIGH. Although I have stated on twitter I am overall bearish, I saw a bullish opportunity. I got on board on initial SUPPORT of this level but failed within minutes. What I could have done better. The level wasnt strong enough so I could have hold and wait longer for second or third touch before initiating trade.

Comment USDJPY:This was a classic downtrend holding range trade. The trade held well below its resistance and respected a fading level almost to the pip. On a third refusal I have decided to go SHORT. The trade went well reaching 1,5R. I kept the trade on. Unfortunatelly at 14:30 came the news and I was stopped out. by few pips. Then it turned down again and reached my initial target. Unfortunatelly without me. What I could have done better? Maybe tightening the SL after no new LL was not created. What do you think?

Leave a Reply