First week trades – AUDUSD (FEB14)

As the week began I have initiated during last four trading sessions (US and EU) more than ten trades. Out of that ten I have picked two I would like to share. One profit and one loss.

Here you go:

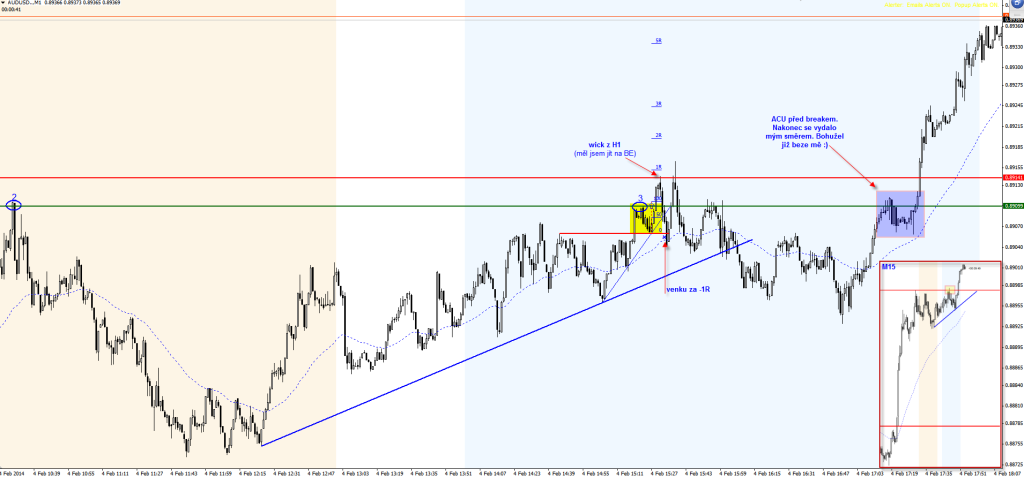

AUDUSD, 4.2.2014: by a first sight it might look like an overbought trade. I always judge the NEWS how it reacted after the news. If the trade runs up and holds in its upper range, that means there are still more buyers than sellers. For that reason I was ready to go long. The idea was right, timing wrong. In this particular trade I made a mistake of going LONG against daily HIGH which was just a few pips away and I could not position myself into a breakeven. Or maybe I could but I did not do it. This was a fatal mistake which I paid for with -1R. Later on the trade went higher to my target. Unfortunatelly already without me.

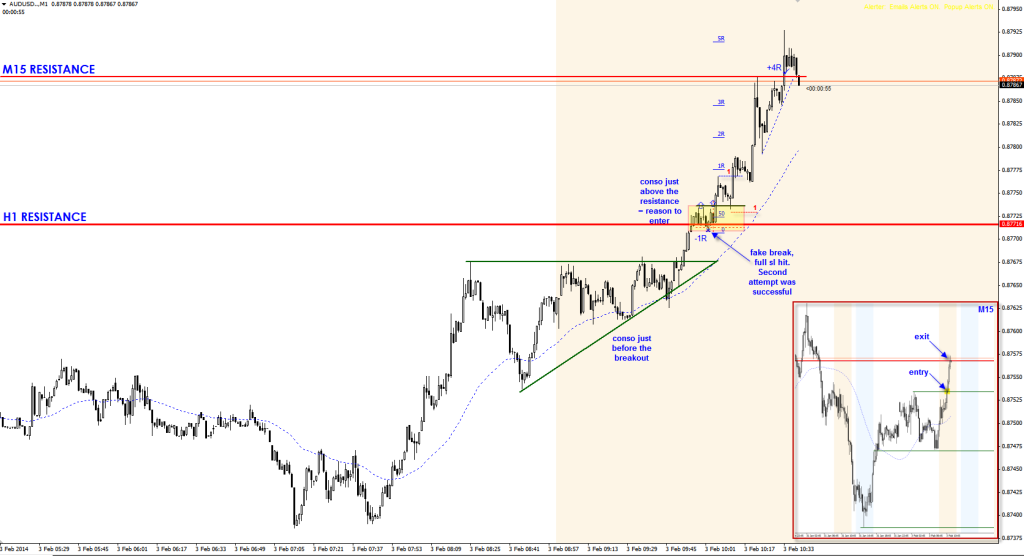

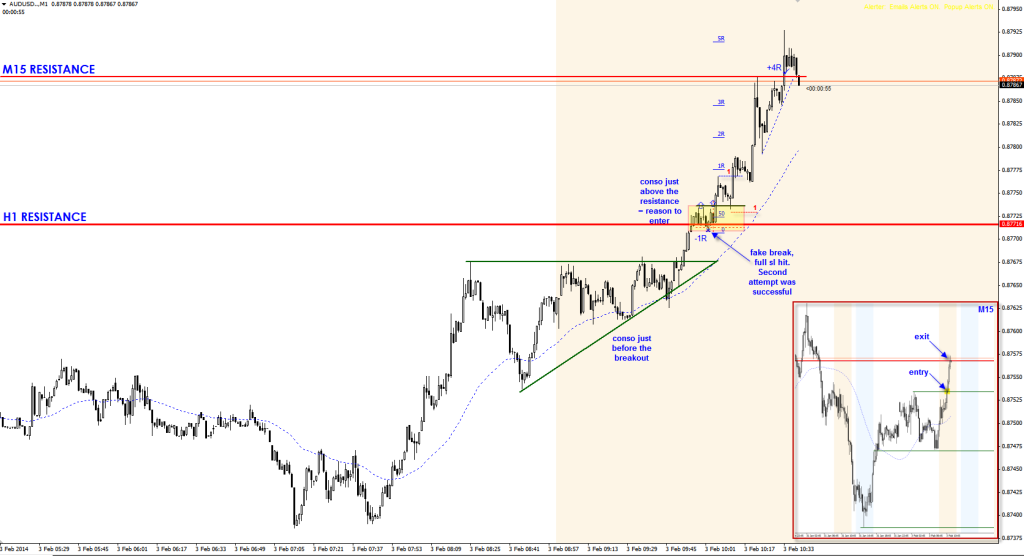

AUDUSD, 3.2.2014: AUDUSD made a great run against a resistance. I liked the trade structure. Notice how it made a runner, then slowed down into a range and held a support (middle green line in the right corner picture) and moved up again. Before the breakout there was an accumulation or bullish conviction represented by higher low creation, creating a triangle before breakout. This was a sign of strength. I went long. Although I have made a +4R return, I was a pussy and should have stayed with the trade longer and get a much higher return. Next picture shows how I should play it.

As you can see, there was a possibility of getting around +15R. Even if I would not hold it to the target, I should have stayed longer and follow my Reason2Exit rules precisely

Leave a Reply