Results of 24-28.2.2014

Last week of February has not provided any increase in equity. Except Yen pairs, FX market was trading for the most part in a range territory. Here are the results:

| Winning percentage | 50% |

| Total number of trades | 18 |

| OGT index | 63,2% |

| Return | -1,3R |

In terms of trades, here are the ones I would like to discuss more deeply:

EURAUD: structure has held nicely and I liked the flip. Once I have seen the pressure coming at the trendline I have decided to prepare my short. As you might have noticed, I like when confluence comes together at precise point of support/trendline break. This time, it did not work out. The pair has broken through my entry but quickly returned back. Once this does not cause the momentum to pick up, you have a reason to exit. Of course I wanted to exit at the best price. So I have waited for price to return to my breaking point and exit there at a loss of -0.1R. If I would not do so, I would end up with a full loss for sure.

AUDJPY: again, confluence played its part (trendline precisely holding the support at fifth circle) as well as flip structure of the play. As you can see, once I have entered, the momentum picked up, but was not strong enough to move pair above the 1R which it reached. I have protected my position once the pair got at 1R. After that it tourned back and I have ended at BE. Good trade.

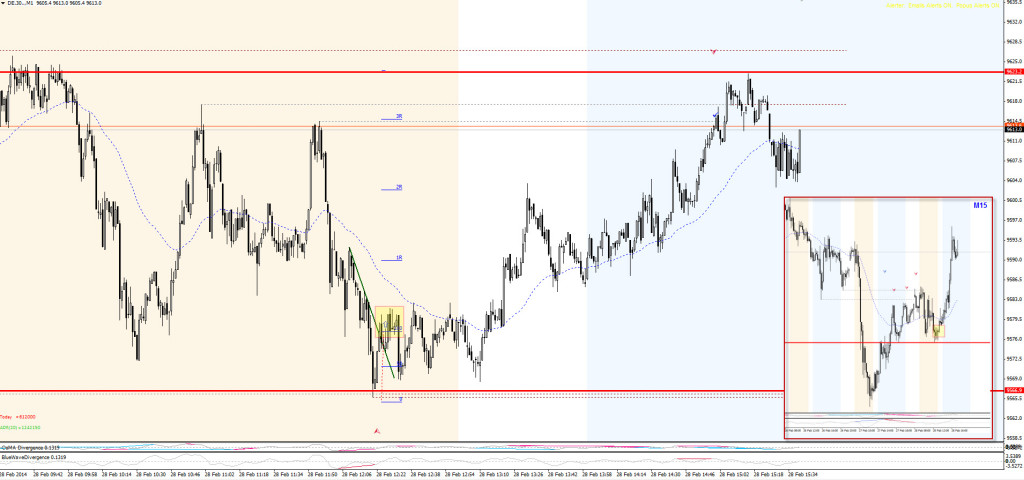

DAX: this was definitely one of the slowest trade of the week finishing at +3R profit. The idea was to go long on the H1 support and fade that support. The entry signal was a divergence of price at this very support. This was a set and forget trade. Once I have entered, I have zoomed out on higher timeframe and set my alarm for +1R to move my SL to BE. After two hours of waiting, my target was hit taking away +3R profit.

TRADE OF THE WEEK

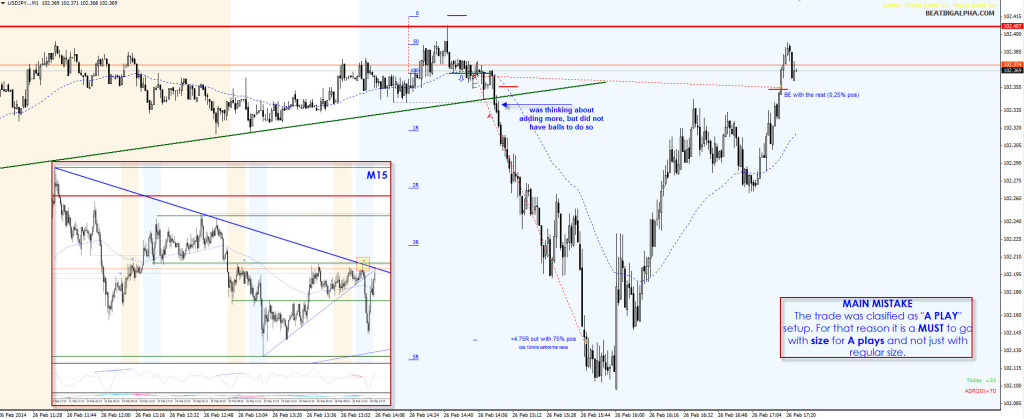

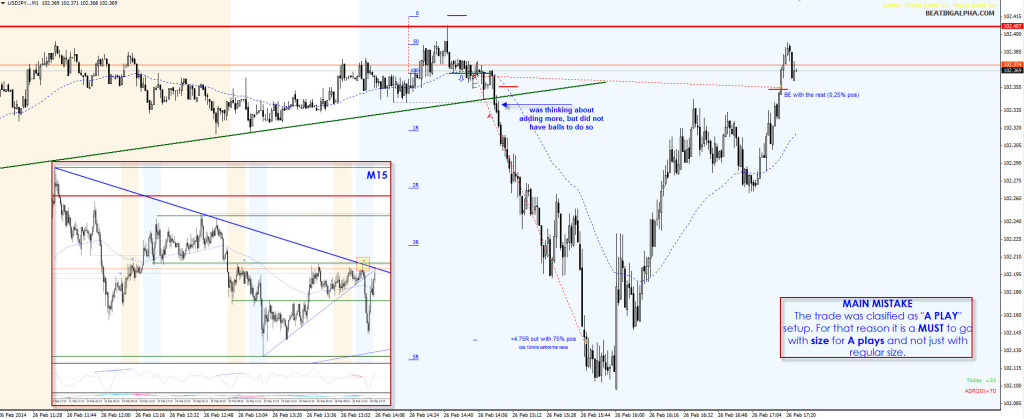

USDJPY: this was the best trade of the week. Again, confluence played it’s role (descending trendline, supported by resistance and divergence) and this time momentum picked up. The good thing I did was exiting 75% of my position at the previous support 10 minutes before the US news (I did not want to gamble with the direction). It was a good decision. If I would not do so, I would end up at breakeven. In terms of full R’s, this trade can be clasified as a full +3.5R winner.

Although I have had two decent trades, I was not able to finish the week above 0. First three days proved to be very tricky and although two trades payed for 90% of my previous losses, it was a hard week to trade in. Anyway, great week to trade and to learn how to play the range market. I will use the knowledge if the market decides to trade in this fashion next time.

Have a great week.

Let’s be better tomorrow.

lechiffre

Leave a Reply