Results of 3-7.3.2014

Here are the stats from last week:

| Winning percentage | 53,3% |

| Total number of trades | 15 |

| Score (points) | 75,0% |

| OGT index | 64,3% |

| Return | +1,4R |

First I am going to start with the trade I’ve believed in but unfortunatelly did not produce any decent return:

GBPAUD: the idea was to go long above the ascending triangle and descending trendline. Since this was a B+ play for me, I have extended the size over two trades. Once I got IN, the market moved a bit in my direction. Then it turned back. I held my both stop-losses at the initial level. Once the market surpassed previous high it was a signal for me to adjust to 1/2 the initial SL. Unfortunatelly after the market has created a new higher high, I could see the momentum did not pick up and started to retracing back. At breakeven I have decided to cut the first trade at BE. Second one I kept just to see, if there is any chance to see momentum to pick up. It tried and was killed, this was my signal to exit with the second position at BE as well. Overall, if I would not do so, I would ended with both pos at a LOSS. Good trades.

GBPAUD: the idea was to go long above the ascending triangle and descending trendline. Since this was a B+ play for me, I have extended the size over two trades. Once I got IN, the market moved a bit in my direction. Then it turned back. I held my both stop-losses at the initial level. Once the market surpassed previous high it was a signal for me to adjust to 1/2 the initial SL. Unfortunatelly after the market has created a new higher high, I could see the momentum did not pick up and started to retracing back. At breakeven I have decided to cut the first trade at BE. Second one I kept just to see, if there is any chance to see momentum to pick up. It tried and was killed, this was my signal to exit with the second position at BE as well. Overall, if I would not do so, I would ended with both pos at a LOSS. Good trades.

USDJPY: next two trades I want to share are the USDJPY short trades. I’ve wanted to short the H1 support. Frist trade play was an ACU play. The market paused for a bit before breaking lower making multidays low. After the market broke, the momentum did not pick up. There was a retrace and reattack of the lows. Once the momentum did not get the breath after second attempt, I knew it was time to get the fuck out. So I did with a moderate loss of -0.2R. Second position was taken from M5 timeframe. It broke the support and moved towards the 1R. There it paused, retraced a bit and created new LL. This was a signal for me to get to BE. Once I did that, the market turned around and hit my SL at BE.

SUCKER OF THE WEEK

SUCKER OF THE WEEK

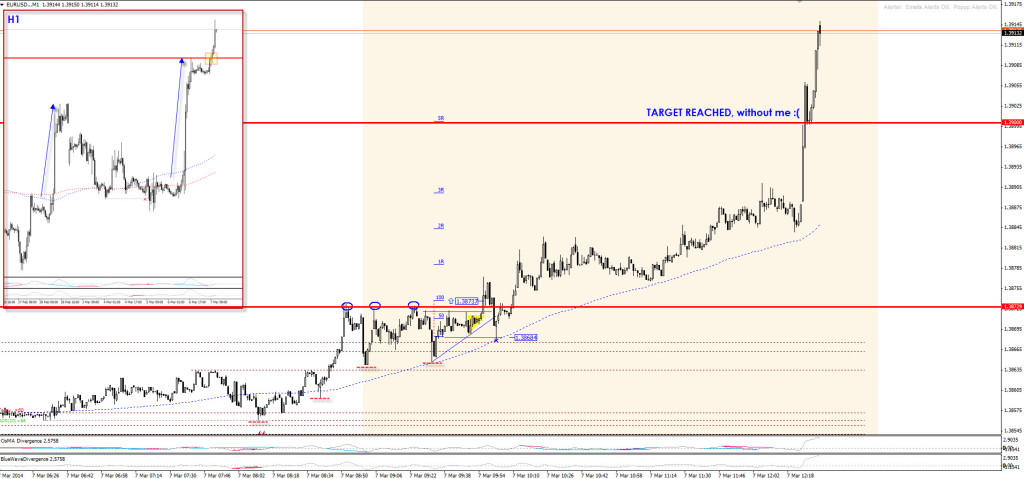

EURUSD: This was very unfortunate. I have loaded up a lot in this position once the market broke the resistance. Once it broke up, it was killed immediately. It tried to reattack the highs but did not create a new higher high. In any other trade, I would exit below the entry, but I wanted to give it a little room (and maybe I was married to a position a bit). So I did. The market then went straight down to my SL and hit it, leaving me with -1R loss. Ouch :(. What was even worse. The SL was hit by tenth of a pip and went up again. After several hours, my target was reached. This type of trade trade is my nightmare trade. I know I have to take some time away from charts, after this happends, because I have a tendency to trade on tilt afterwards. There is one thing I could have done better. I could have looked at the ascending trendline and position my SL just below it. Most likely, I would not get stopped out. Well, next time.

TRADE OF THE WEEK:

TRADE OF THE WEEK:

AUDUSD: finally, my trade of the week. Again, it is friday, afternoon, after NFP that formed first leg and its support. The market is creating a descending triangle towards this NEWS candle low. This usually creates a lot of traction below this low and if the market creates a triangle there, it is perfect opportunity to enter, get to BE and hold the position. I have entered, then market retraced. After the entry, market started to retrace. I have decided not to adjust SL straight away to BE. If I would do so, I would be most probably stopped out. After the retrace was done and the pair created a LL I have moved my SL to BE. From there the first target was clear and was within an hour. I was struggling on two occasions. First, in the green zone, where I was expecting some buying pressure and second near my second target, where I could have hold longer. This goes to my Reason2Exit which I have violated. Anyway, overall it was a good trade with few lessons for the next one 🙂

Have a lovely weekend and remember.

Let’s be better tomorrow.

lechiffre

Leave a Reply