Results of 24-31.3.2014

After a while I am bringing top winners and top losses for the last week of March. Here are the results:

| Winning percentage | 57,9% |

| Total number of trades | 19 |

| Return [R] | 9,1 |

Here is the selection of winners and losers you can take the most:

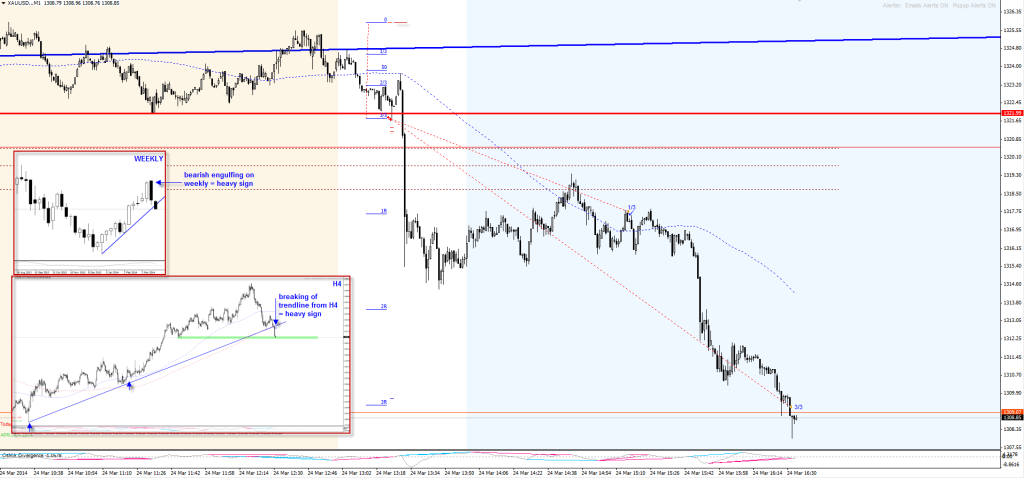

GOLD: definitely a trade of the week since I have decided to put twice the size I am putting usually. Why? There were several technical reasons. The gold has had a nice bullish run and was weakening. The bearish weekly engulfing was suggesting we saw the top. The market was just at the daily trend line and the pretty precise technical support was just below the daily trendline. Seeing all this, it was a “I must take this position” trade. After the market broke the support, it retraced a bit and I was shitting blood :). But then a huge seller apeared and drop the bid veery quickly through my entry support towards my 1R. It got as far as 1.6R and then started to retrace. Here came the classic “you are not going to steal my money bitch” mindset. I needed to take some pressure of and at that time it seemed that the position is reversing. So I have taken 1/3 off the table just to leave with some sure profit. As it used to be, the price did not go any higher and slowly went straight down towards my target. Lesssons learnt? 1] i could have stayed longer in the trade since the next daily support was at 1285. 2] I should have re-added that 1/3 i have taken of at the break of the next support. Overall, the best trade in terms of size I have taken. Total profit of +3R.

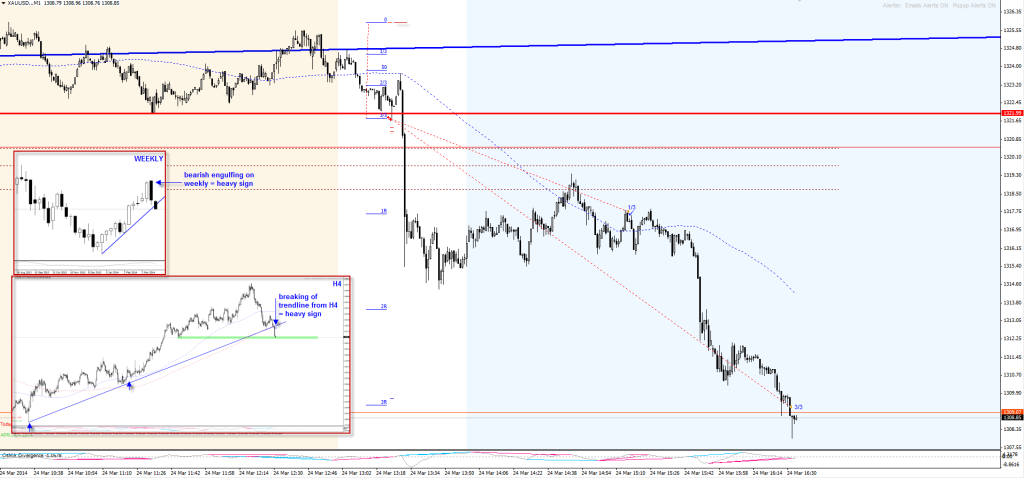

DAX: after the DAX got to the downtrending trendline I have seen the potential of shorting a triangle pattern just below this trendline. The only problem was, and I did not see it at the time, the market was simply in a strong uptrend intraday. Strong open, consolidation and strong run again. This was just a second leg and as my experience goes, there is most of the time a third attempt to push the market higher if the market is trending intraday nicely. As it turned out, I was entering the position and the very support of this next leg move. In both positions I was able to exit at -0.4R and the lesson was: when going against strong intraday trend, you need more then just a pattern and trendline. More confluence like stronger resistance or inverse H&S resistance. All in all, -0.8R.

DAX: what a lovely PLAY this was. Market rallied on the open. Paused and pullbacked a bit and then started to grind higher pressing the H1 resistance. On the third push I knew my risk is well defined and I have to go for it. So I did. Not much to say. The position went straight up to my target and I have exited at +4R.

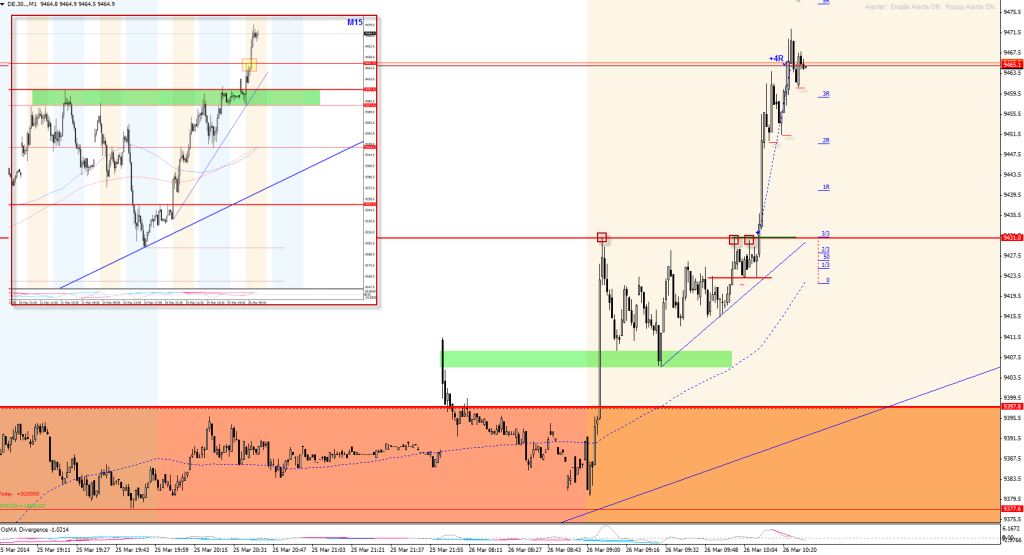

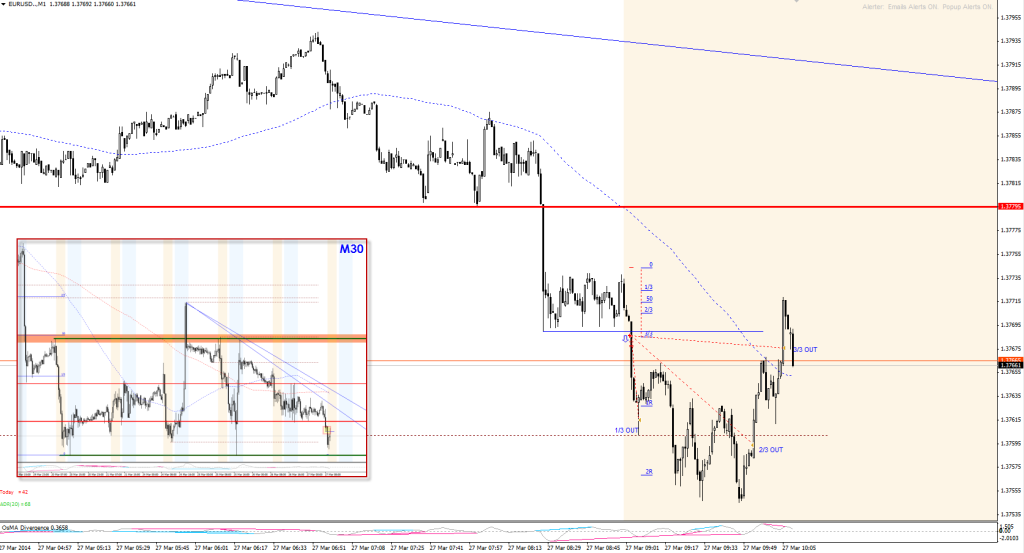

EURSUD: with it’s low volatility is a tough nut to crack these days. This day was a different. There was a nice run after European open and tight conso. A play I like to call a RAR (Run, Await, Run). The idea is simple. The market runs quickly creating a strong move. Then it stops and consolidate into a tight range or triangle and then continues creating the same leg in terms of pipsize as with the first run. The target should have been at 2R but I guess I wanted to see more (greedy bastard). At first support ahead I have exited a 1/3. Since the next push did not go much further I have exited 1/3. And the last pos ended at BE. So overall +1R profit totally.

AUDUSD: V bottom break turned out to be a fake breakout. The idea was supported by the H1 rising trendline. Result: -0.5R

EURAUD: this was a triangle play supported by fade the resistance context. Again, It got me by a tenth of a pip and reversed leaving me with full stop-loss = -1R. Lesson: I was shorting into a prev intraday consolidation which is not a great thing in terms of a probability of succcess.

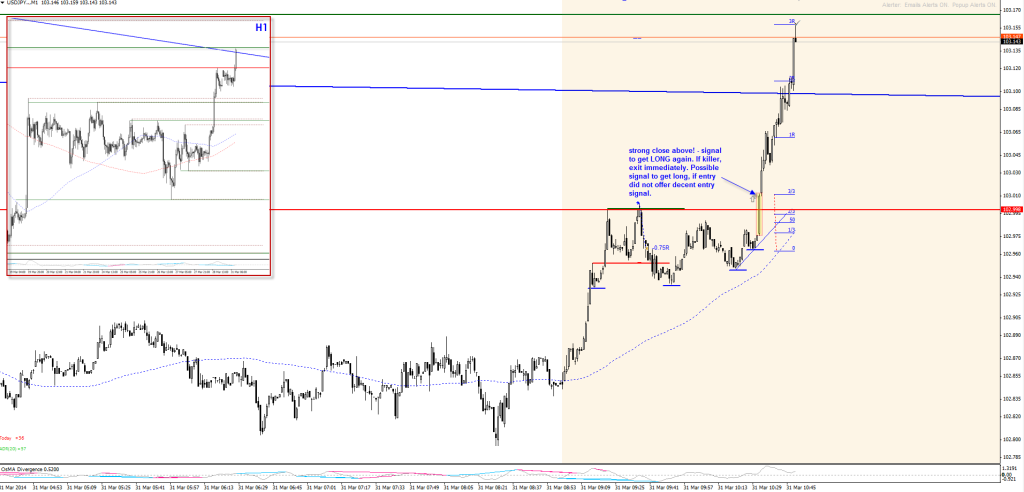

USDJPY: this was a bit of a “I want to go desperately long with big size” trade and the play was not perfect. The idea behind was a second day play. USDJPY rallied the day before leaving just a little conso behind which gave me the sense it wants to go higher. With my entry I did not wait for pressure to build. I just liked that before the break, the support of the last mini pullback held. That was my reason 2 enter. When the market finally broke above later, I was just looking at it. The lesson: when the market takes those high of a resistance, retraces and slowly starts to grind higher again, look for another potential entry especially when the break is strong. Overall: -0.75R

Leave a Reply