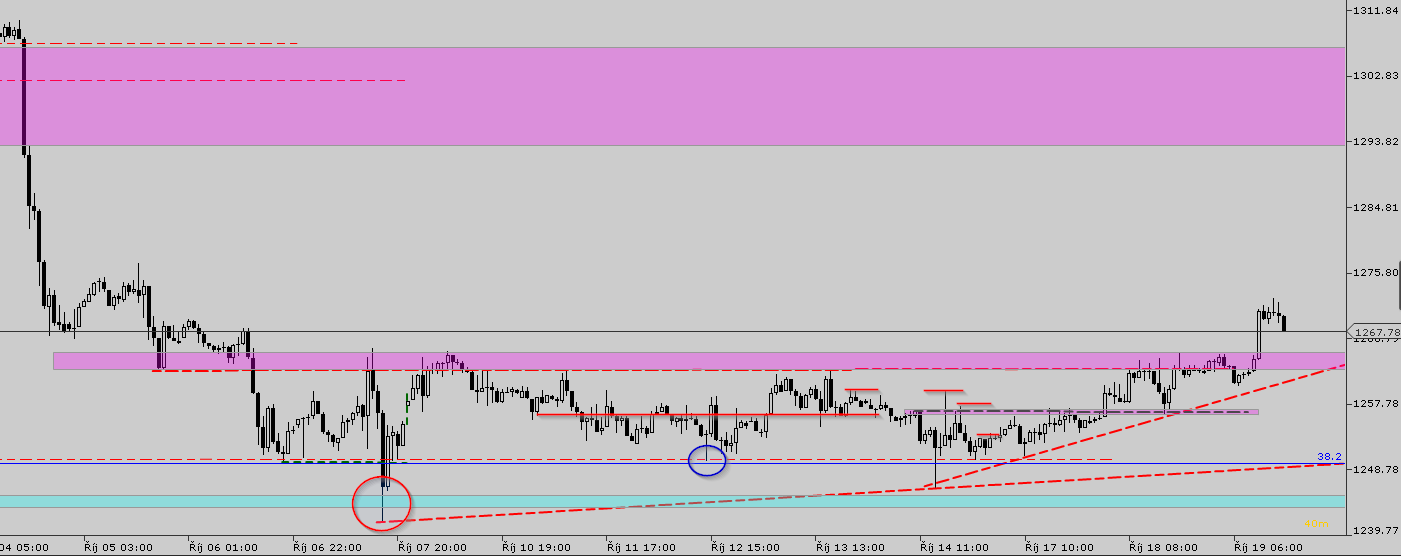

TRADE, GOLD, 17.10.2016

TRADE SUMMARY: decent IDp but not great, very good structure, confluence with 38%. Wick structure. Markte then balanced in a bear trap creating lower high. This led me to conclusion that I should exit at market. Held position over weekend and closed for little profit after the open. Well. The rest is history. Market from that moment on in a nice zig zag pattern broke 1264 without me. That led me to conclusion: did I exit correctly

Good:

- Spot on

- Discount entry

- Holding for multiple days with unknown result

- Exit above BE

Bad:

- Focused on profit, rather then structure

- where is the awarness zone? Is market closing into it?

To Improve:

- Define awareness zone and what you are looking at there

- Have a plan for a range – how to evaluate right exit

- Ask yourself – why do you exit at all cost at certain price?

Result:

+0,1R

SCREENS:

D1

H1

Market dived into a DEMAND zone, then retraced back. Held in range, retraced back to second leg. Now starts the trick period. If you compare thousand ranges in the GOLD. What is the probability that this range would hold?

Leave a Reply