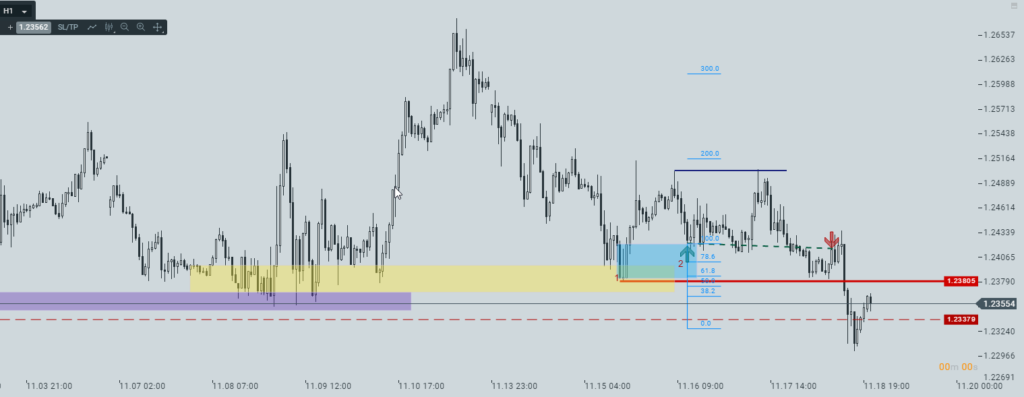

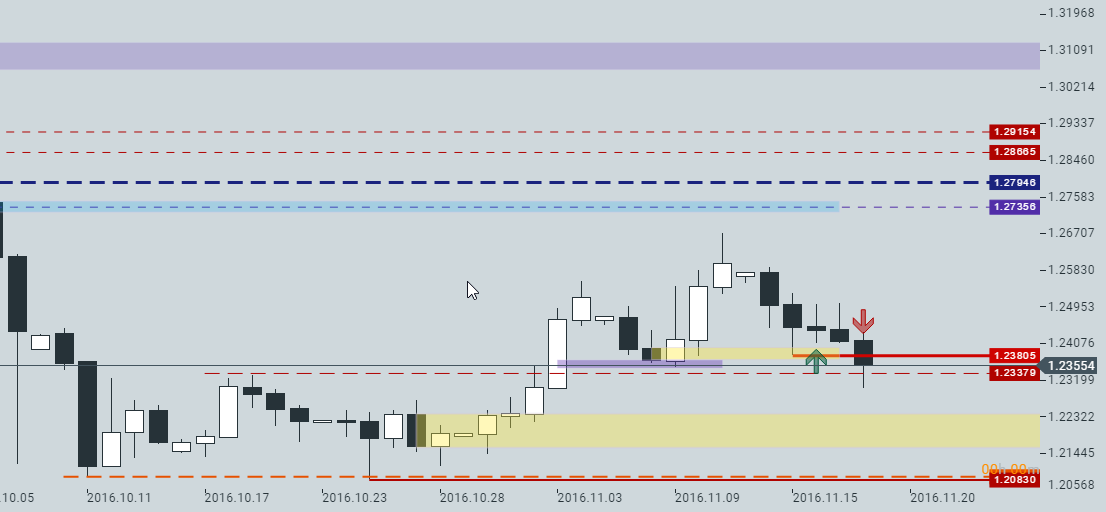

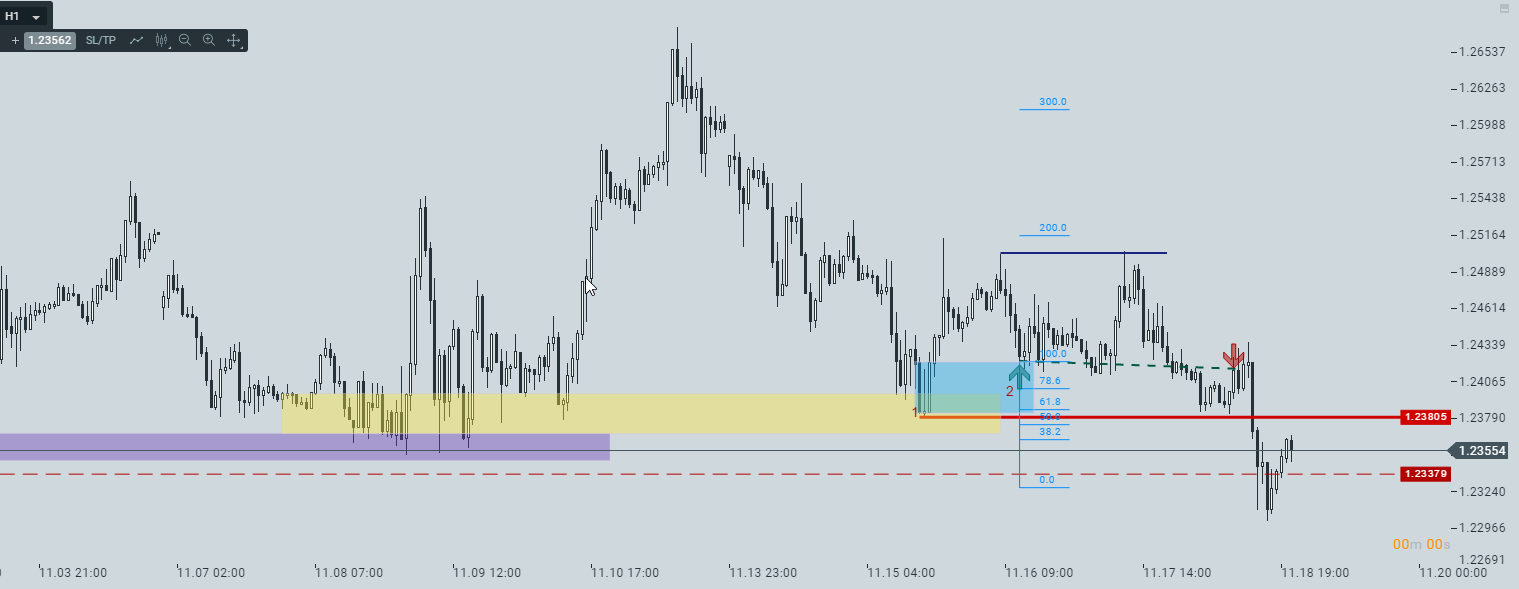

TRADE, GBPUSD, 15.11.2016

TRADE SUMMARY:market broke 2337 and went higher, which was a critical flip for GBPUSD. After the break, the retest confirmed this level as a flip to hold. Demand was set. When market returned, I got in through the demand hit play on H1. Market then hold the level strongly resisting the strength of USDX. After two days, the pressure broke below 2408, which was my awarness zone, meaning: be careful, if market closes here, market wants to hunt lower prices. Since the break was strong, I have setup an exit TP at the BE on the return being able to exit with a scratch smaller then 0,1R. I was lucky. Market retraced to my TP, and then shit itself. I would end up in full -1R loss. This time I was able to manage my exit out and end up with BE result. Good trade.

Pattern

- SDZP

Good:

- Spot on identification, big picture support and H1

- Managing the trade

- Exiting from the trade with TP on a retrace back to BE after my awareness zone CRACKED

Bad:

- Did not manage the drawing of: obstacles

- Did not grade the trade

To Improve:

- Remember to GRADE and DRAW OBSTACLES

Result:

BE

SCREENS:D1

H1

Leave a Reply