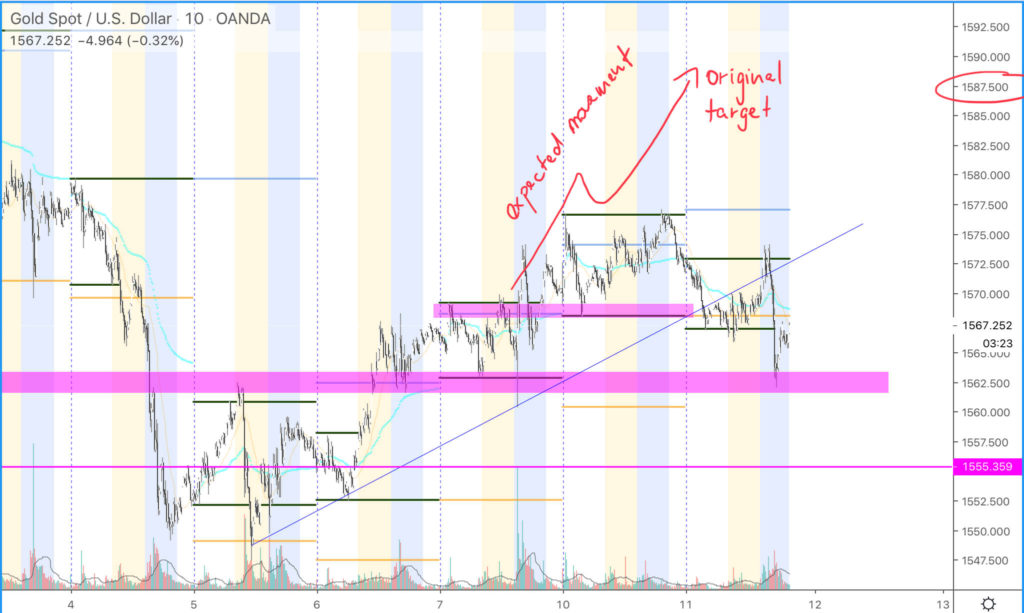

GOLD case study #3 for February 2020

General methodology

I have very briefly described my methodology for choosing the trade here. Please read it if you want to understand the table below.

Application of methodology

Trade Review

Why to take this trade

This trade was a classic #breakandhold above type of play. This type of play was triggered, when flip (purple zone around 1562) started to hold. The problem (from hindsight) with this trade was couple of nuances, that weren’t strong and I have put too much confidence in them:

- base was formed at the 1550 level, level that did not hold any strong significance

- rejection of the base was moderately strong, but not super strong

- entry to this trade was on the NFP day and Primary act was suppose to be as a fade of ASL (Asian Session Low) which could not be executed due to expected news

- expectation that the move will break and run from 1568 was based on a wish, not a strong nuance such as multiday resistance breakout

Since NFP triggered a move higher, I get in on my secondary act, buying a breakout which is a type of trade I feel more and more uncomfortable with. Act I am starting to consider a “suckers” type of entry. Timing is key in trading! You can be right 80% of the time, but if your timing is wrong, you will still lose money.

Down below are two additional screens describing the context why I took this trade.

My expectation about the speed of reaching the target were based on overconfidence but not a technical reasoning (wave count, multiday range breakout).

Another piece for the context was this symmetrical triangle going in a favour of continuation.

Trade management

My entry was not so bad. I am glad I have waited for NFP to be announced and entered after. My Primary act of buying the breakout was bit clouded with past experience of trending day after the number for the rest of the day. That was my expectation that market will then move roughly to 1578. So my target was not too far of a dream. On the other hand, my type of entry did not allow me room for big error or too range bound market.

Key Takeaways

What I liked

I likes about this trade definitely the decision to wait for NFP and the way, that I have exit when market did not move in a way I was expecting it to move after breakout.

What I can do better next time

Here are more deep considerations I have to include in my decision making process

- when making a trade, consider the act of getting in. If you are not scalping, your trade must be positioned to have room for defense (#suckerstrade)

- understand when you are scalping and when you are putting swing trade (scalp vs swing trade)

- how realistic it is for your trade to go after the breakout directionally to your target. Is your expectation of speed of reaching the target realistic? (speed of reaching target)

- aren’t you putting too much confidence in a trade setup, that has moderate strength (strength of the trade)

- aren’t you too overconfident with the overall trade overlooking all the above

Regarding all of the above, of course it is easier from the hindsight. But having the right expectation and understanding the confidence behind the trade (what are the drivers) is important in making a good trade.

Leave a Reply