USDJPY case study #2 for December 2019

General methodology

I have very briefly described my methodology for choosing the trade here, if you want to understand the table below

Application of methodology

Trade Review

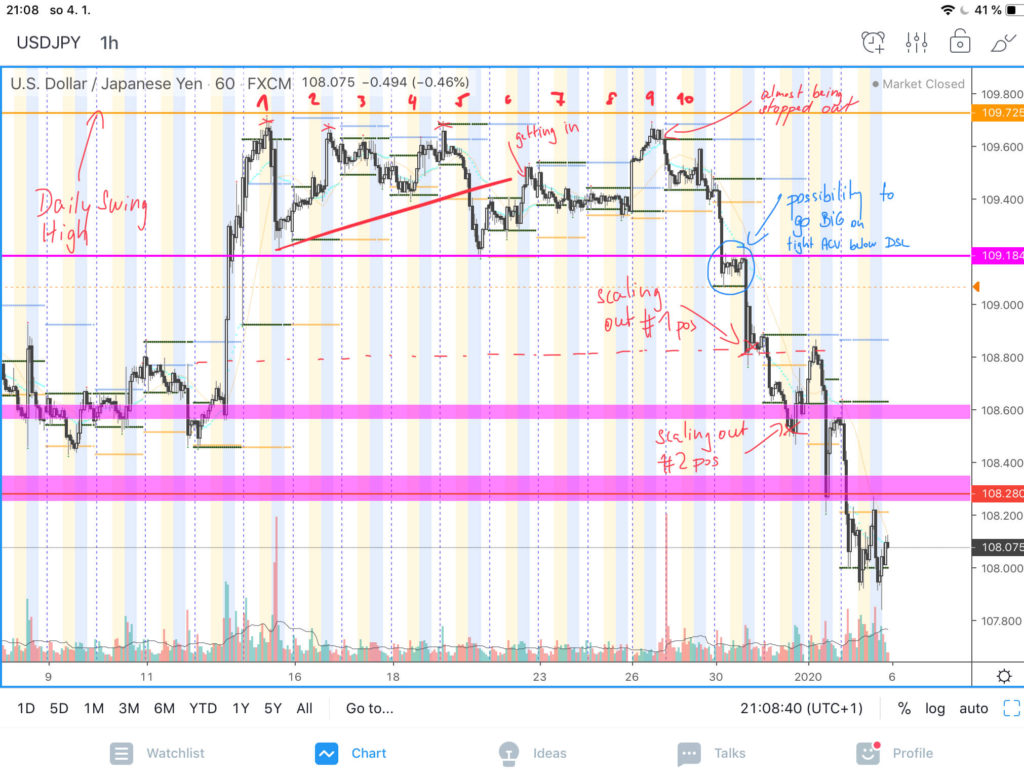

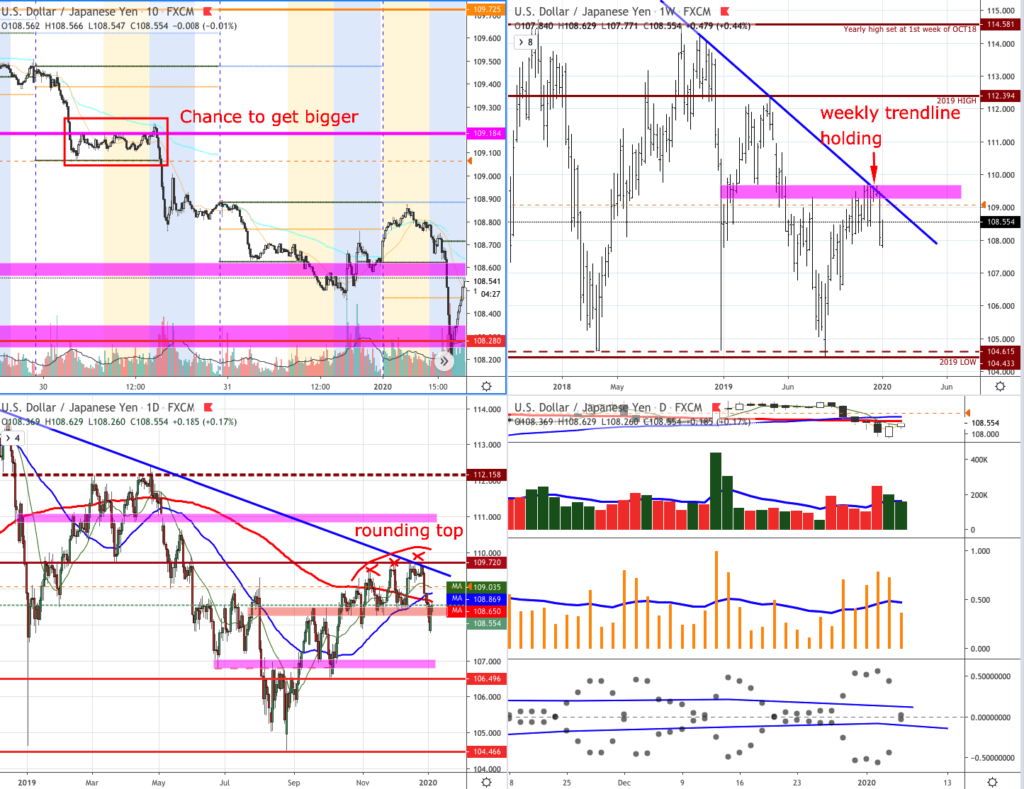

DSE (Daily Swing Extreme), in this case High (DSH – the orange line at the top of the image) has not been breached. Multiple variables played in my favour but there were also some variable that played against me (as always). Here is the list what was against me:

- market was still trending higher

- there was a strong breakout move on the 12.12.2019

- Until 19th of Dec 2019 the pressure was bullish, not bearish

What played in my favour were primarily these features

- rounding daily top

- nft (no follow through) after runner move (holding below 109.70’s)

- weekly bearish trendline

- Christmas liquidity

If I should highlight just one thing, it would be definitely the pressure to hold below 109.70 (DSE) and inability for the USDJPY to move higher. This gave me the confidence to start trading this pair.

Key Takeaways

What I liked

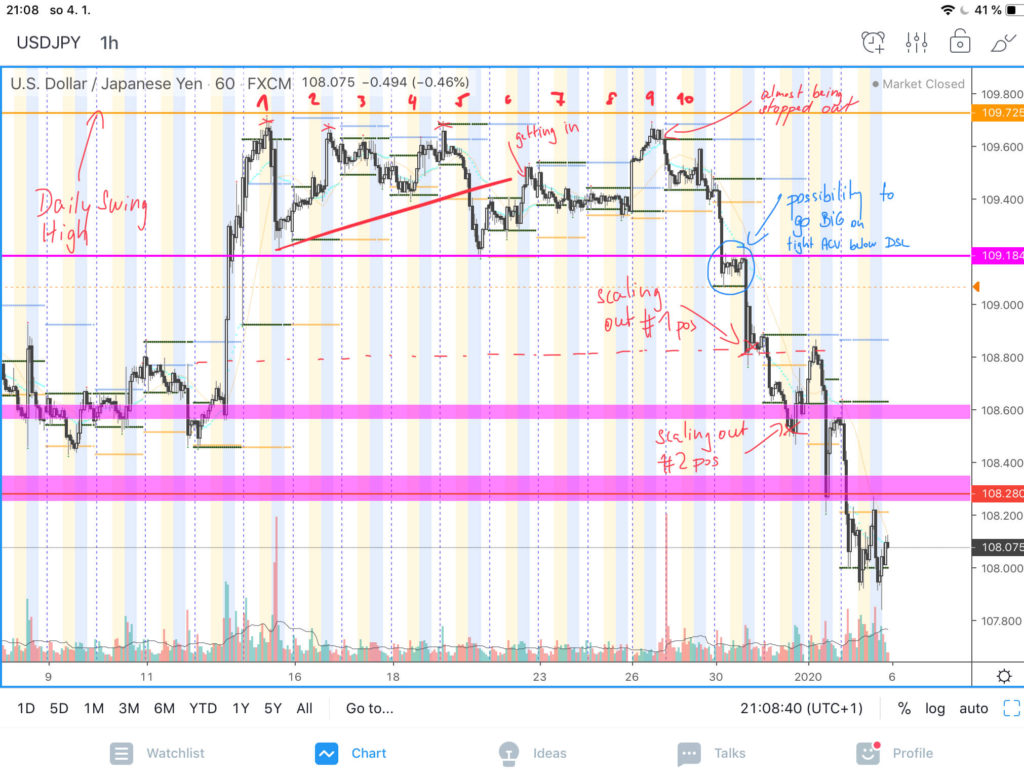

What I liked about the trade was, that I entered mid range (balance zone) to get more favourable RR. I was almost stopped out but I would re-enter at least one more time if the balance zone would still hold and trade would be valid. I have also liked the way I have scaled out of the trade (see #1 and #2 scaling out on the image above)

What I can do better next time

- I could have averaged in more positions around the mid of the balance zone (at least 2 or 3). I got in pretty early before inside day range was so more extended.

- There was unique opportunity for aggressive, short time-frame Holding below POL play after we broke this 10 day balance zone. Although I was not actively sitting in front of the screen, something to watch for future.

Overall this was a nice trend to end the 2019 year green and profitable.

lechiffre

Leave a Reply