20130105 – ACU trade (-0.3R)

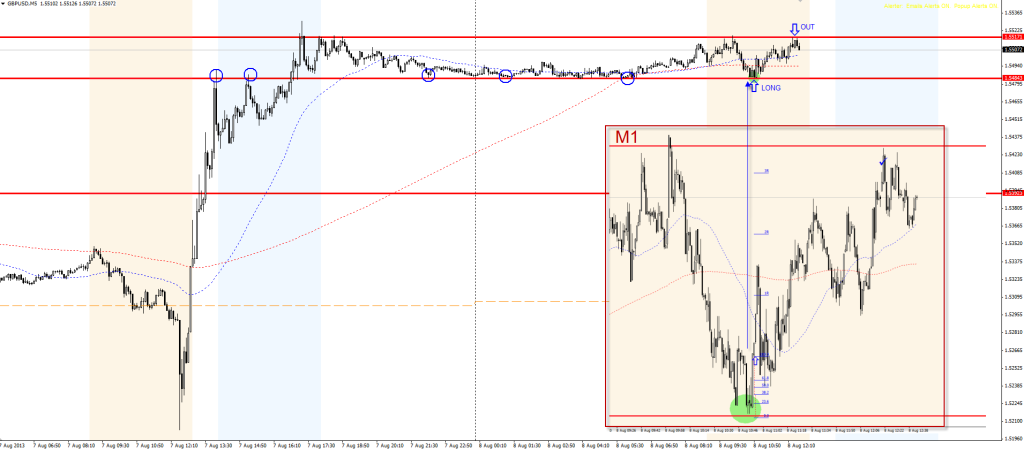

This is one of the classic examples of a stop-loss fuckup. The pair is trading higher. At the high there is a resistance. The resistance holds but price doesnt retrace much. That is a good sign of a strong market. If the price is able to hold in a range just below the HIGH, there is a high chance that break will occur. So once I have spotted a stronger price action just below this level, I have decided to bet BUY STOP order. The order was hit and reached as high as 2R. Then it reversed. One of the rules once the market gets to 2R is to look for a new spot where to put SL. That means at 0,5 – BE. I have decided to place it at 0,3SL. WRONG! I did not respect the levels, and the market took my position literaly by a pip. So that is the first mistake: always place a stop, where it matters from a long term perspective.

Second. I should load the boat again after my SL was hit. Why? Well the bounce of the breaking level was decent. The 1.30 level was ahead and since the run up was quite strong, I was counting on 1.30 to be hit. It did, but without me. Wrong! If you are out of your position you must re-act again if the play is there. The ACU and FIF was there. With the ACU the wrongdoing was the SL adjustment. With the FIF, the wrongdoing was in not entering the trade at all.

To sum it all, the trade could have been easily a 6R opportunity. Instead, it was a -0.3R opportunity. Inches matters. In every trade!

Trade well.

lechiffre

Leave a Reply