About

I have been trading since 2008. This journey dates back to my university years.

Uni dormitory trading setup:

First office after leaving university (2011):

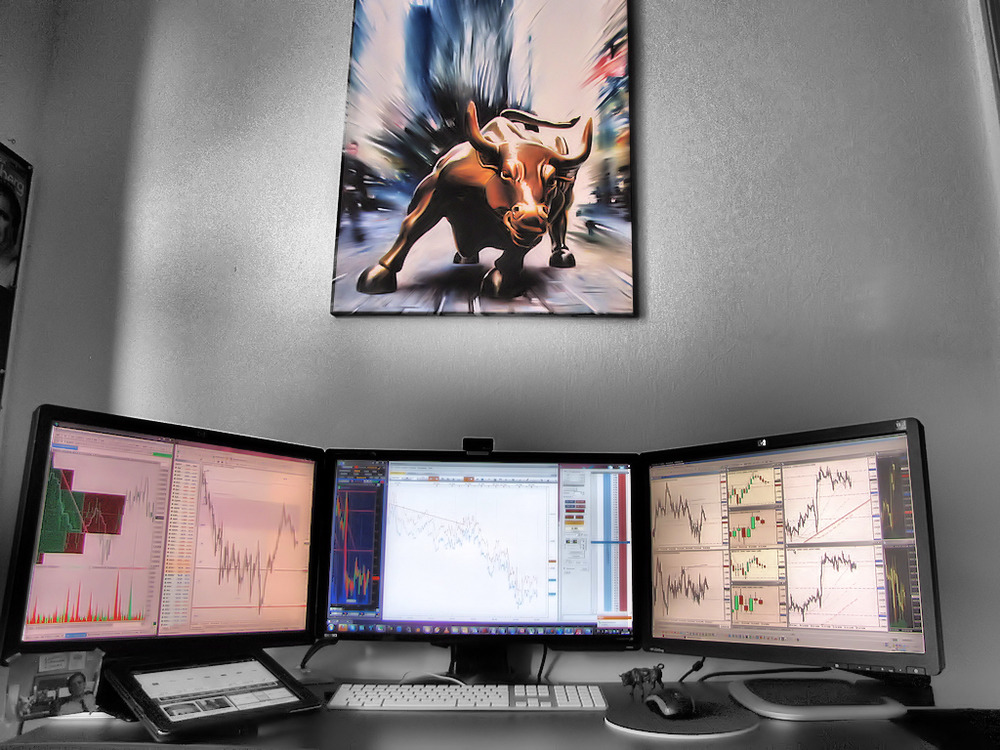

Second office trading setup (2014):

Turning pro:

In 2020 I have joined Axia Futures crew (the best futures trading firm in the world) and moved to their Wroclaw office to trade proper size on the state of the art technology, platform, brokerage and connectivity line.

Tomáš Novák

February 7, 2014 at 9:45 pmAhoj,

jenom sem k tobě nakouknul a nestačím zírat a chválím.

Tomáš ze Školytradingu

lechiffre

February 9, 2014 at 12:07 amChválit není třeba :). Pokud můj obsah pomůže či inspiruje, tak to je pro mě ta největší pochvala.