Results of 10-14.2.2014

Last week has proven to be difficult in terms of directional moves. Most of my entries finished at break even but due to some mistakes made in EURJPY I have finished the week down -5.6R. Since I have started trading thin volume this drawdown is below 1% my overall account size so nothing disasterous. As of every trade, it is important to learn from our own mistakes. Here are some of trades you can learn from too:

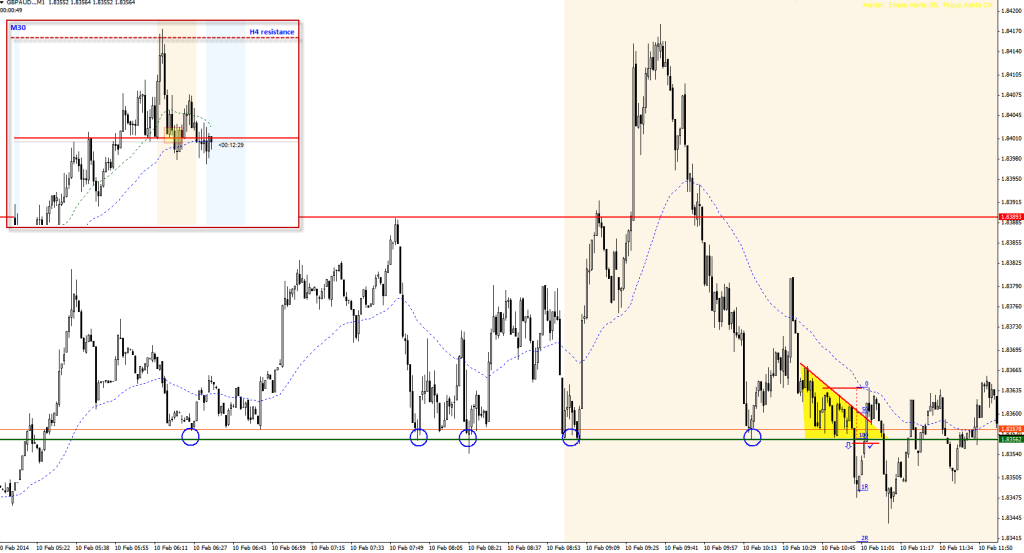

GBPAUD: the level was clearly visible and respected. The action before the break was more wicky, but I liked the level. I knew if the momentum picks up, it can be a nice slide. The momentum did pick up, just for one minute :). Then it stopped. If you see this happening, it is usally time to cover your ass. So I did. I have readjusted my SL to BE and let the position do what it has to do. If I would not do so, I would be OUT with a loss. Good decission.

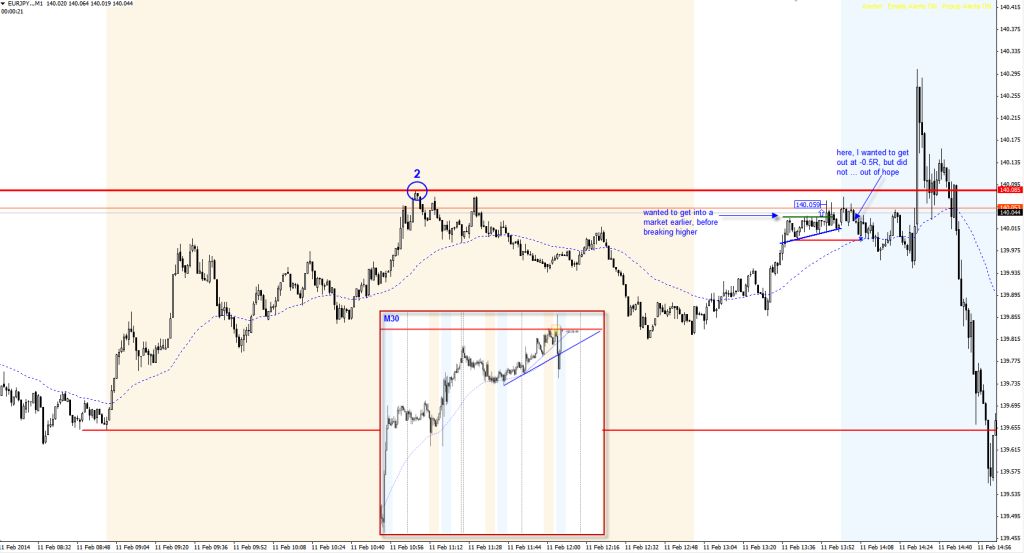

EURJPY: this position has proven to be a mistake. Looking at it now, I do not like it. But at the time of the trade, I remember I was very confident with the position. What was my thinking? I wanted to get in before the crowd breaks higher above the red line. Bulls were in control, there was a pressure to the upside and my greedy part repeated: “get there with a little stop-loss, it is going to be a huge return if it would break higher”. High risk reward was in front of my eyes which blinded my decision process in which I question: how technical is the move?, is it holding certain level?, what is the overall strucutre? To put it simply: There was not a clear ground in terms of clearly visible and respected RESISTANCE LEVEL. The very BASIC element was not there. This was a bad decission. Next time, I would not enter in such a play.

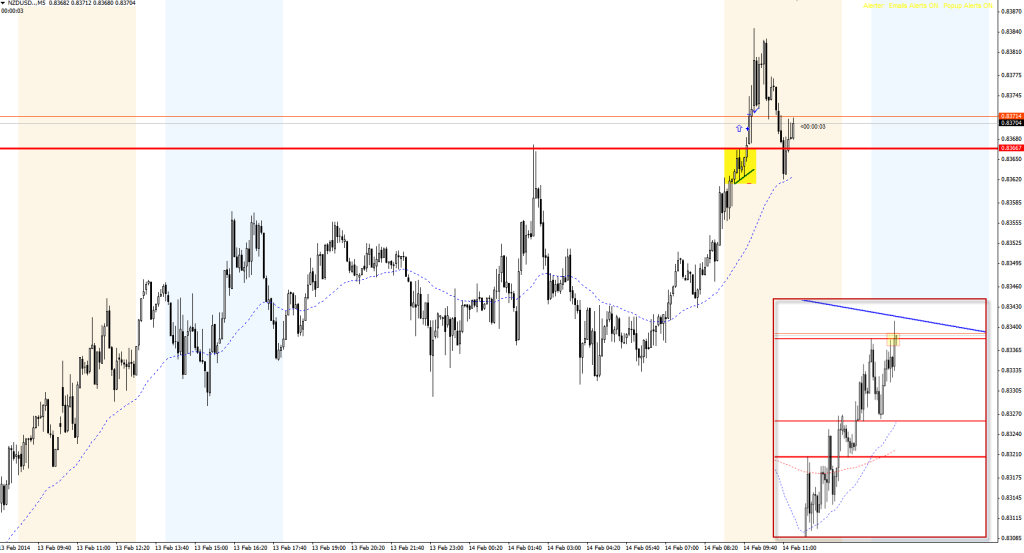

EURUSD: well this is a different beast. If you see a downhill move like that and triangeling like that towards the support, prepare for the continuation move. Although I was stopped out at break even, I really liked this position and the stop was positioned correctly. The wrongdoing, or notdoing to be precise was my inaction (grey down arrow). There, I should have re-entered the position and slide it down for +3R profit. Well, I did not. I was a pussy. This was supposed to be a trade worth taking.

NZDUSD: this was one of the last trades of the week. Not much to say. It was a good trade which ended up at breakeven. If I see it again, I would repeat it exactly as I did here.

As I have said at the beginning. Plenty of nondirectional moves and some of my mistakes were cause for this week’s results. Goal for the next week is to take only the H1 visible levels entries, visualizing and going through all my historical A plays, taking A plays trades, trading low sized positions and waiting for the direction to return.

So what do you do when you have had a negative week? How do you recover, how do you adjust?

Feel free to leave comments.

Let’s be better tomorrow!

lechiffre

Leave a Reply