Results of 17-21.2.2014

Last week has proven to be directional on Thursday and Friday as I have expected. There were plenty of opportunities to find and if I have counted right, if you would take every single play, there were about 20 to 30R’s. Out of that I took “only” +11R which is a first decent week after very silent two and a half weeks in Feb14.

As usual I have picked winners and losers as well and draw main conclusion from the last week.

Lets start with EURAUD. Level was taken and easily visible on H1. I liked the pressure on the level before the break. Well, it was a good level. It was a good play but this time did not work out. The good thing I did was my exit. I was ready for a POP. The pair did not find any momentum and retraced a bit. Then the pair tried it a gain and did not surpass previous high. If you expect a pop, you have to be aggressive with your position. After seeing that I have exited manually with a small loss. About fifteen minutes later, the pair attacked the previous resistance again and finished at +5R. Unfortunatelly, I have not noticed. That’s trading. Neext.

Lets start with EURAUD. Level was taken and easily visible on H1. I liked the pressure on the level before the break. Well, it was a good level. It was a good play but this time did not work out. The good thing I did was my exit. I was ready for a POP. The pair did not find any momentum and retraced a bit. Then the pair tried it a gain and did not surpass previous high. If you expect a pop, you have to be aggressive with your position. After seeing that I have exited manually with a small loss. About fifteen minutes later, the pair attacked the previous resistance again and finished at +5R. Unfortunatelly, I have not noticed. That’s trading. Neext.

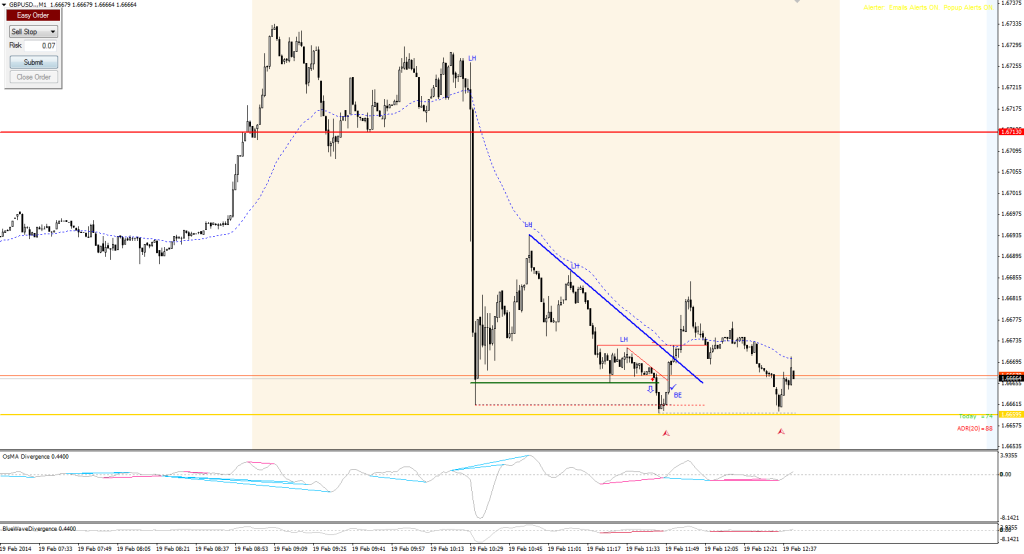

In this GBPUSD position, the idea was to go short on the pressure at the green line after the news consolidation. Again, I wanted to be very aggressive with my stop, so once the wick (created by news previously) got touched, I have adjusted my SL to BE. It was a good decision. I was out at BE and if I would not adjust my SL, I would be out at -1R.

And finally Thursday came. The day, when I have suspected we might find some direction. And we did. I really liked the position. The support, the trend, pressure. It went all in line with my expectation so I have pumped a size a bit and went in on the sell stop order below the green line. I was not that heavy in my life so I could feel my heart beat. But the entry payed of. I was planning to hold the position for little longer, but I was simply to heavy to leave this type of position on the table. It was a good decision. After few hours later, the pair was back at my break level again. Definitely a trade of the week in terms of size and structure (+5R). This was truly my A play trade.

And finally Thursday came. The day, when I have suspected we might find some direction. And we did. I really liked the position. The support, the trend, pressure. It went all in line with my expectation so I have pumped a size a bit and went in on the sell stop order below the green line. I was not that heavy in my life so I could feel my heart beat. But the entry payed of. I was planning to hold the position for little longer, but I was simply to heavy to leave this type of position on the table. It was a good decision. After few hours later, the pair was back at my break level again. Definitely a trade of the week in terms of size and structure (+5R). This was truly my A play trade.

And since Thursday has proven to be a great day. Friday was even better. In this day, there were so many opportunities, I did not know, which one I should take :). No, seriously, in terms of visible opportunities which made sense to me and went to my predetermined targets, Friday 21.2.2014 was the best day of February 2014. In this GBPAUD the idea was again. Visible resistance, good base, good run from the base, structure and pressure. It was all there. I have classified this play as an A play, until it broke the resistance withtout offering the ACU entry signal. Once it broke the resistance, it got into a small range. This caused my declasification to B play and for that reason also a smaller size. If I average it down, the position ended up being a +4R profit. What I could have done better? Well, I definitely could have stayed in that trade longer. My Reason2Exit list was not followed as planned. So in terms of profit, good. In terms of exit, not so well and I need to work on the habits of following the reason to exit more.

Conclusion:

Out of 14 realized trades I was able to squeeze out +11.4R which is the best result so far, while managing the money. In that +11.4R, there were 14trades in total. Out of that were 3 profits, 6losses and 6 BE. And what is the conclusion? Trading is a game of inches, sometimes you have to wait for days or weeks for a good day or two and dont do anything stupid in a meantime.

Trade well.

And … let’s be better 😉

Leave a Reply