Results of 10-14.3.2014

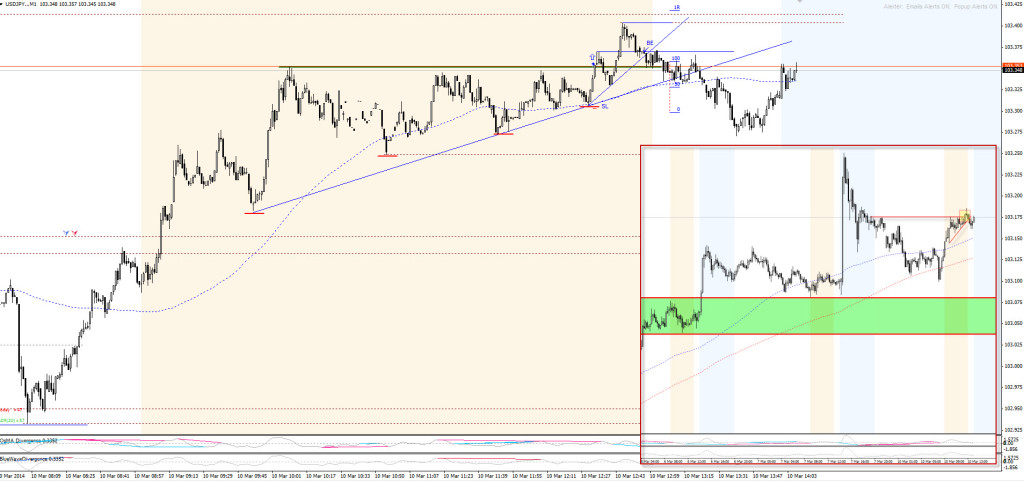

USDJPY: break of a resistance created a little push above the resist and slide back (my full stop was still on and there is nothing worse then full stop). Fortunatelly, the market retraced back above and the previous high was surpassed, I have moved my SL to BE. After that, market retraced back and I was out at 0. Neext.

USDJPY: break of a resistance created a little push above the resist and slide back (my full stop was still on and there is nothing worse then full stop). Fortunatelly, the market retraced back above and the previous high was surpassed, I have moved my SL to BE. After that, market retraced back and I was out at 0. Neext.

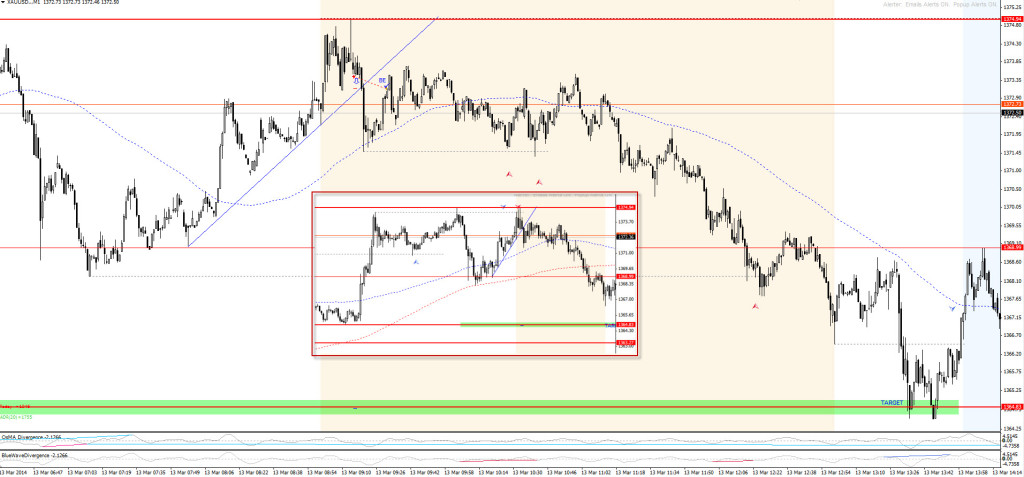

GOLD: This was the third push of gold higher which had failed. What I’ve liked about this particular trade was the signal I have noticed on GC futures. There was a huge volume imbalance at that wick on the third push and upthrust of volume. This gave me the confidence, that the market might need to look lower first. The PLAY context was there, now it was time to look for play entry. There was a well respected trendline. My entry point was just below. Once broken, I got as far as to 1R but then the market retraced back finishing me at BE.

GOLD: This was the third push of gold higher which had failed. What I’ve liked about this particular trade was the signal I have noticed on GC futures. There was a huge volume imbalance at that wick on the third push and upthrust of volume. This gave me the confidence, that the market might need to look lower first. The PLAY context was there, now it was time to look for play entry. There was a well respected trendline. My entry point was just below. Once broken, I got as far as to 1R but then the market retraced back finishing me at BE.

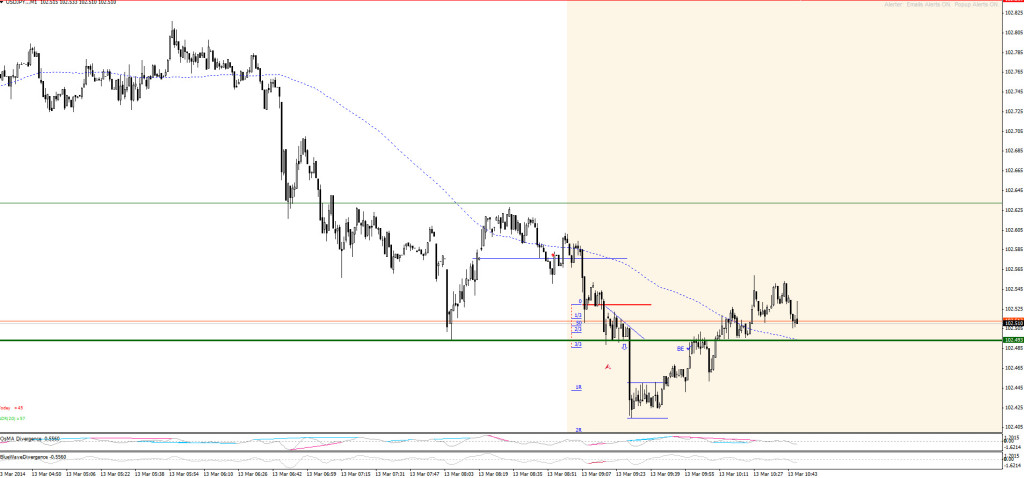

USDJPY: the pressure was on. It was just after the London open, when the pair started to create triangle pretty tightly at the support. The order broke through and quickly get to 2R. Then stayed in a chop and moved in symmetrical waves higher. As soon as it was in that down range, I felt confident. Once it has broken to the upside, I knew I might be in trouble. In about 10mins market hit my adjusted stop-loss and I was out at BE.

USDJPY: this was a DIV play. What I like about the DIV plays is what has to precede them. Divergence is the last piece to the puzzle, a crutch as my friend like to call it. Why? Because they are everywhere but if put into context, they can help. What I liked here was a drive through the resistance (red line). Slow retracement and reaction to the pip at the support (prev. resistance). I wanted to go IN as soon as the trendline was broken. Once I was in, there was bit of a struggle with taking off. After that came one retracement. If I have waited for the resistance to break and entering higher, I would be most definitely at BE and would be stopped out but since my entry was bit lower, I was protected by this S/R. Trendline break helped to get into market earlier. After all this was a good +3R profit! Finally! But I’ve had to wait for it for until Thursday.

USDJPY: this was a DIV play. What I like about the DIV plays is what has to precede them. Divergence is the last piece to the puzzle, a crutch as my friend like to call it. Why? Because they are everywhere but if put into context, they can help. What I liked here was a drive through the resistance (red line). Slow retracement and reaction to the pip at the support (prev. resistance). I wanted to go IN as soon as the trendline was broken. Once I was in, there was bit of a struggle with taking off. After that came one retracement. If I have waited for the resistance to break and entering higher, I would be most definitely at BE and would be stopped out but since my entry was bit lower, I was protected by this S/R. Trendline break helped to get into market earlier. After all this was a good +3R profit! Finally! But I’ve had to wait for it for until Thursday.

EURJPY (trade of the week) – do you see that green line at the top of the chart? That was an important resistance. And that blue trendline? That was an important higher timeframe trendline. What that have meant to me? That, … this is the trade where you add size. This is a high risk, high reward trade where you have to swallow and get bigger. Of course. Although this was my most profitable trade to that date (money wise), I could have hold the position longer. This was a possible +20R trade but finished as a 10R trade. So what is my lesson? To replay the trade over and over again while imagining I hold big size position because it was truly that size which led me to cut the profits sooner than I should.

EURJPY (trade of the week) – do you see that green line at the top of the chart? That was an important resistance. And that blue trendline? That was an important higher timeframe trendline. What that have meant to me? That, … this is the trade where you add size. This is a high risk, high reward trade where you have to swallow and get bigger. Of course. Although this was my most profitable trade to that date (money wise), I could have hold the position longer. This was a possible +20R trade but finished as a 10R trade. So what is my lesson? To replay the trade over and over again while imagining I hold big size position because it was truly that size which led me to cut the profits sooner than I should.

Have a great weekend.

lechiffre

let’s be better tomorrow

Leave a Reply