My biased breakout trades in EURUSD

It has been a while since I have written about a trade I took. I wanted to share with you my recent trade from Thursday 13.11.2014 which has kind of a different logic behind that some of my trades in the past.

For the last four months I have been working on my edge. In many trades I just felt that I m trading just the pattern without having real bias behind the trade. I believe that patterns on it’s own do not offer a sound edge. Yep, surprise, surprise. Because even if your pattern works temporarily and you can lock some profit for a trade, if you want to hold the trade for a swing for example (and earn decent R), you simply cannot go to BE since plenty of times your BE is just a spot worth retesting for the market. So you get taken out only to see your TP to be reached. Right? Been there, done that.

So how I define my edge and time when is the pattern worth taking and when not? Bias! How I define my bias? That is a simple question but the answer is complicated. To put it simple, I try to understand where we are in context of fear and greed of bull’s and bears and position myself as close as possible to area where my idea/hypo will be invalidated. Where I will be wrong.

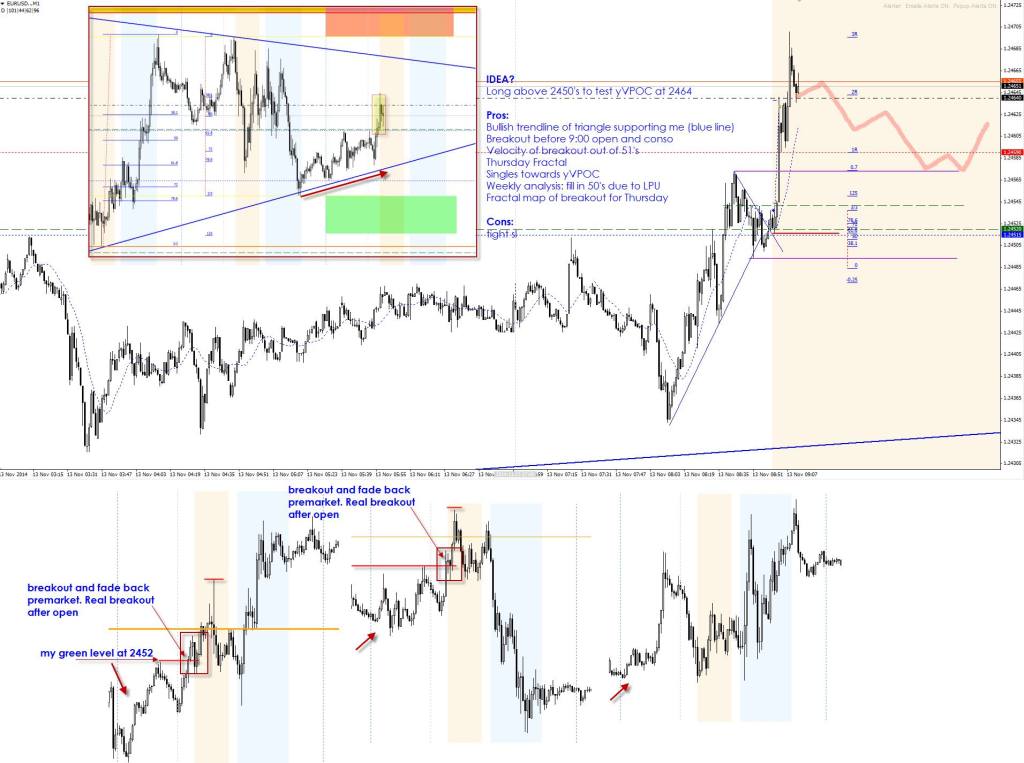

How I define and construct bias I will leave for other post. There are variables that define my map for the day. One of the variable I use for trading EURUSD specifically, is a database of moves during asian/london/ny session going long back in time. Since these moves repeat, I m trying to find in history a pattern or map if you wish, that the day will be following. Some call it a fractal, I call it a map. Once I find my map and the map is confirming my bias I structure my trades around this. Simply it means that I will take trades only at certain levels, one direction only and at times during the day when I have the highest chance that the trade would work for me. So enough of this chit chat. Here was my trading map for Thursday:

My stats told me, that there are two possible maps for Thursday. I knew the context and bias so I could have define the day more precisely. Just before the open I took the trade based on my map/price action and my bias.

Since this was what happened on my map, I was confident to take a flush long after the open. The trade was quick, few minutes long and finished with 1,8R.

Since this was what happened on my map, I was confident to take a flush long after the open. The trade was quick, few minutes long and finished with 1,8R.

Then I was waiting for my map to confirm in the afternoon with the direction. Once the lower green zone held and the market started to create higher low, I knew that I have to get long. Again, I was expecting a flush. I waited for my pattern and hit market again. Maybe I got lucky, but I was out again within several minutes with 1.3R.

Then I was waiting for my map to confirm in the afternoon with the direction. Once the lower green zone held and the market started to create higher low, I knew that I have to get long. Again, I was expecting a flush. I waited for my pattern and hit market again. Maybe I got lucky, but I was out again within several minutes with 1.3R.

If you can take one thing from this article, take this: pattern itself is not enough. Conventional TA is not enough. Have a framework, have a bias and use patterns to execute your ideas based on this framework/bias.

Jorge

October 28, 2019 at 11:43 pmHola Alpha me llamo Jorge quiero aprender necesito aprender mas de los fractales y como aplicar en el mercado.

lechiffre

November 10, 2019 at 6:27 pmWhat do you wanna know?