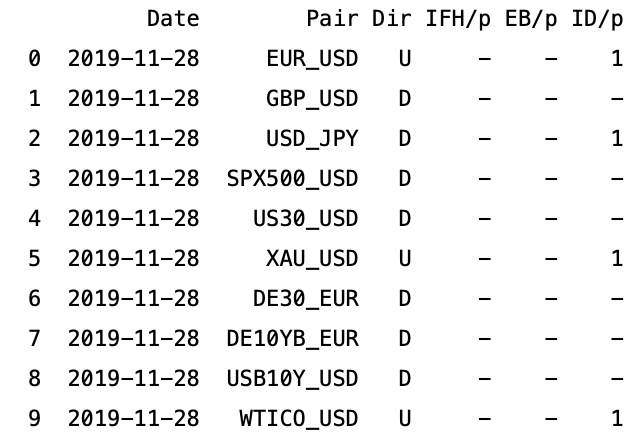

USDJPY – fat finger, htf’s clash, weather … does it really matter?

One fun fact about yesterday’s move is definitely volume. The average volume on M1’s is 300’s. Now yesterday when the move happend, the minute the move was initiated, there were 5000ish contracts traded. This type of volume occurs usually around big news releases like rate cut decissions and nfp’s. The minute after though, the market traded 12000ish contracts. Something what is definitely not usual but not totally unusual although it is 40x times the average volume traded in 6Js on M1’s.

If you happend to be a buyer AT THE MARKET, there was a blank spot where you would enter almost 20points above your initial entry (ouch). This lack of counterparty is typical for GOLD, where rapid price moves are more typical.

If you happend to be a buyer AT THE MARKET, there was a blank spot where you would enter almost 20points above your initial entry (ouch). This lack of counterparty is typical for GOLD, where rapid price moves are more typical.

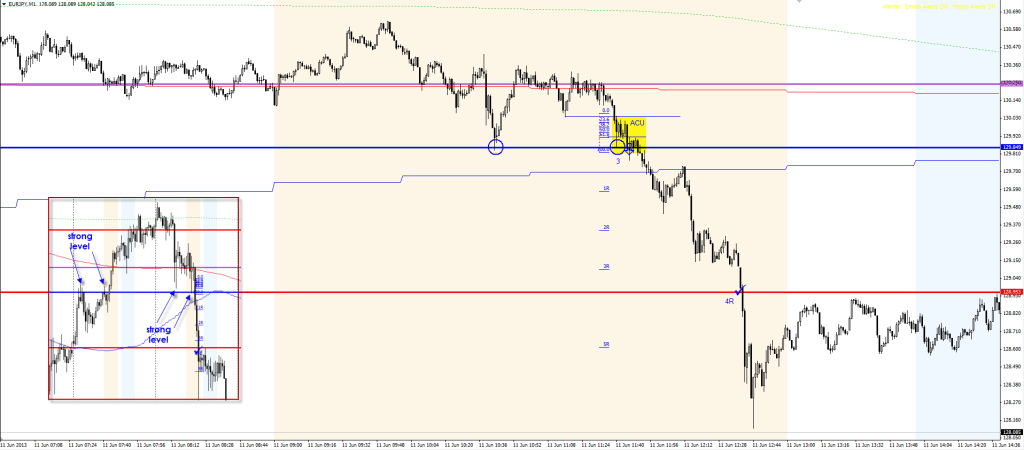

Fat finger or not, I do not think that really matters. It is fun to look at but does not bring any value. What matters is the price. Where it went and where it is now and how we can play it going forward.

Fat finger or not, I do not think that really matters. It is fun to look at but does not bring any value. What matters is the price. Where it went and where it is now and how we can play it going forward.

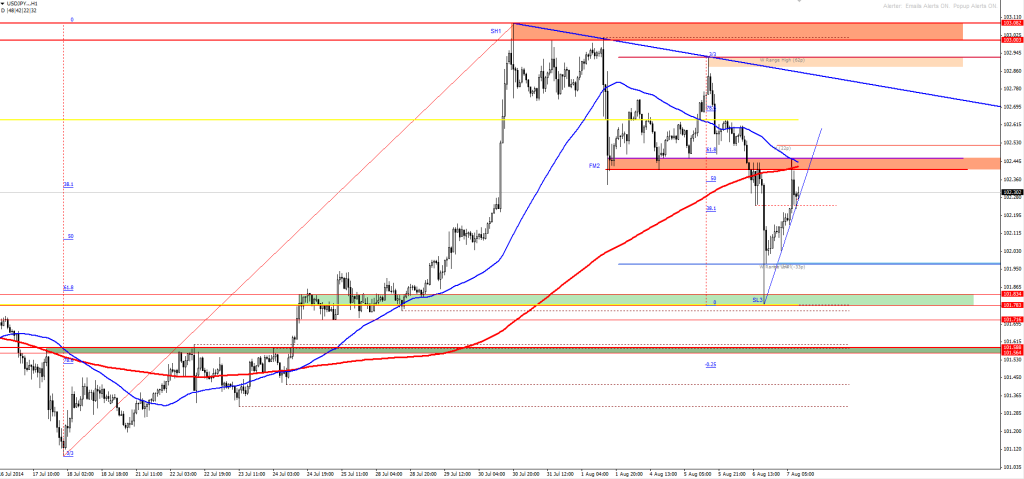

Judging by H1, you can easily say: “look, this is the uptrend with a nice parabolic acceleration at the top of the move. This move down is a 61.8ret finished by the aka “fat finger” spike low which is nothing else than USD profit-taking. The recent structure sugessts a possible cup and handle formation with a nice V spike bottom following back to 103. I am a BULL looking for places to get long where 102.45 would be my place to get long again.”

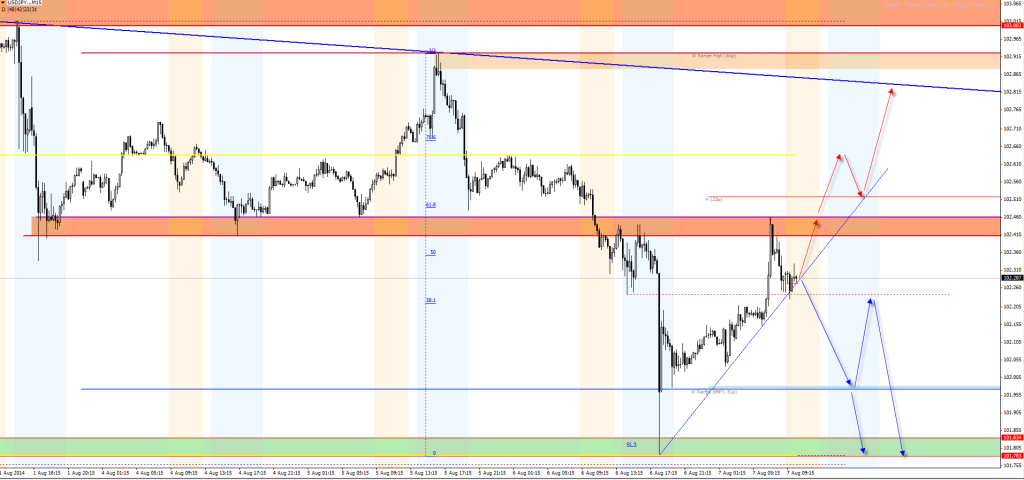

Judging by M15 you can say: “look, the price action is pressing the downside, plus we are in a daily range over the last several months. It would be wiser for me to play the short side. I am looking for shorts around 102.45 towards the 102 and eventually 102.80’s. I am a BEAR”

Judging by M15 you can say: “look, the price action is pressing the downside, plus we are in a daily range over the last several months. It would be wiser for me to play the short side. I am looking for shorts around 102.45 towards the 102 and eventually 102.80’s. I am a BEAR”

Summary: whether you are bullish or bearish, 103’s, 102.40’s, 102’s and 101.80’s are the levels to watch. What was the cause of yesterday’s move is a history. What is my view? I am a bear as long as the price is pressing below 102.40’s to the downside.

Good luck and have a great trading session.

Leave a Reply