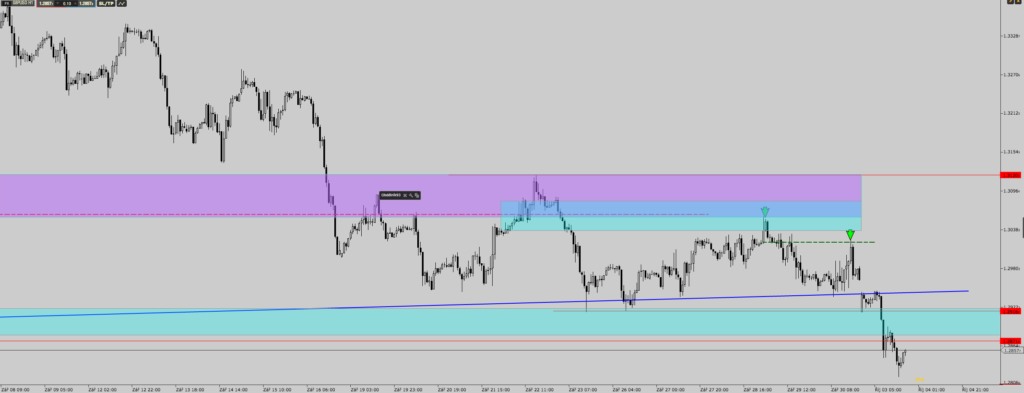

TRADE, GOLD, 26.10.2016

TRADE SUMMARY: market continued to highs without be. What a sorrow feeling seeing market move without you. Anyway, observation of the GOLD helped to form a new entry around FLIP zone. Well defended flip zone became a good zone of entry. My entry spot was higher, but was not taken by few ticks (pure luck), that gave me better entry . Market then did all type of fuckery, comments from some asshole came to drag the GOLD up and then straight DOWN. That got me worry a little. By that moment I draw an AZ (awarness zone) where I would exit if the zone did not hold. That did not happen and market went higher. Took stops and stopped. Creating a high, this led to a downhill move again but limited retracement. Decided to exit this trade and not hold it any longer. Time will be the judge of my decission.